Rapid Financial Service Process Optimization with Low-Code

Hangyin Consumer Finance was established in December 2015. Approved by the China Banking and Insurance Regulatory Commission, it was initiated by Hangzhou Bank and co-founded with Didi, Intime, and other well-known enterprises.

Traditional development cycles at Hangyin Consumer Finance were lengthy and complex, which would not meet their needs during a time of rapid growth. Internal business demands, due to lower prioritization, suffered from limited development resources, slowing down digital transformation.

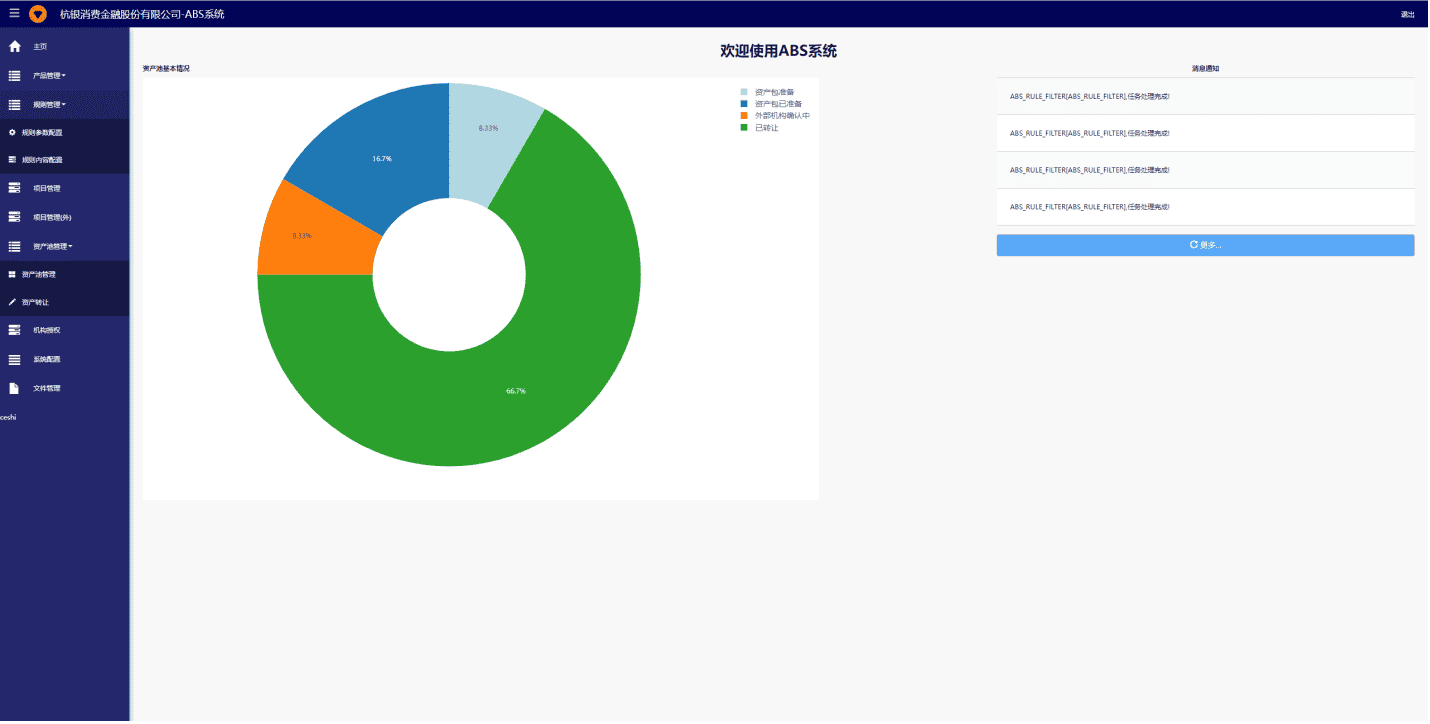

Levering the Mendix low-code platform, Hangyin Consumer Finance was able to develop several business applications, including an asset securitization system. This approach solved the inefficiencies and high error rates of traditional development, ensuring precise resource allocation and high-quality outputs.

Developing Business Apps Fast

As Zhejiang Province’s first licensed consumer finance company, Hangyin Consumer Finance has a registered capital of 2.561 billion RMB and over a thousand employees. Its main services include consumer finance, with flagship products “Zunxiang Loan” and “Qingxiang Loan.”

In 2022, the company paid over 800 million RMB in taxes and won multiple honors, including “Outstanding Contribution Enterprise” and “Industry Leader in Innovation.”

As the company grew, its internal management systems required greater sophistication and precision. The complexity, rapid changes, and high customization demands of these systems made traditional development tools inefficient.

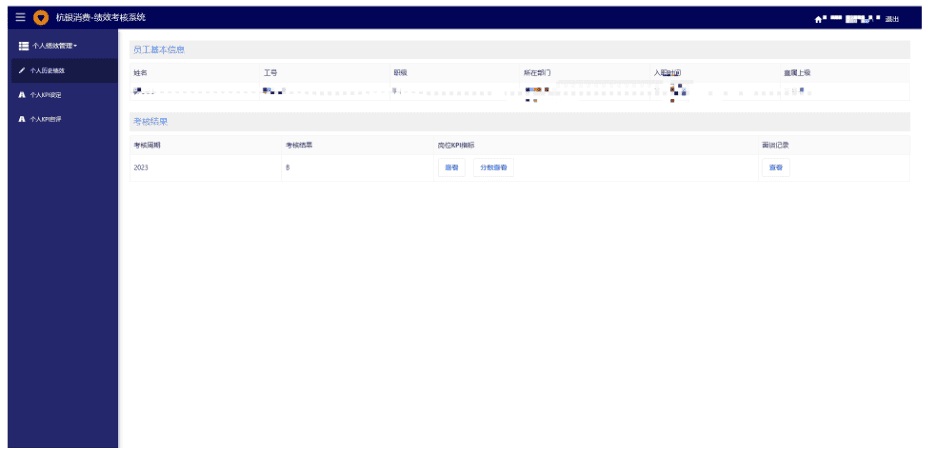

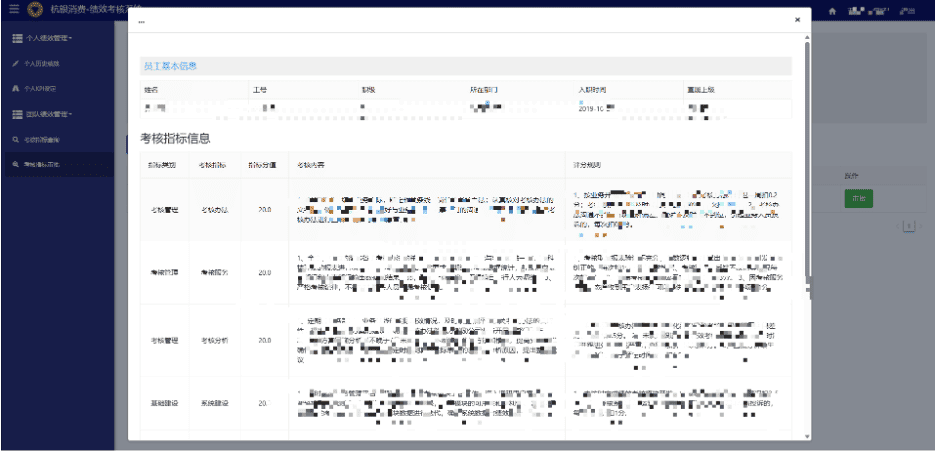

For example, the company’s performance evaluation platform, previously handled manually in Excel, became increasingly challenging to manage as employee numbers and assessment diversity grew. A specialized system was necessary to support performance evaluations.

The challenge was to allocate development resources efficiently while achieving high-quality outputs—a goal that required rethinking development processes.

Hangyin Consumer Finance’s low-code team identified the Mendix platform through Gartner’s 2021 Magic Quadrant for Enterprise Low-Code Platforms, where it was a leader for three consecutive years.

After consultations and demonstrations with Mendix experts, the team found that Mendix aligned with their technical development roadmap. They decided to implement Mendix for internal management systems to meet business demands rapidly and effectively.

Internal Process Efficiency

Over the past six months, Hangyin Consumer Finance developed the following applications using Mendix:

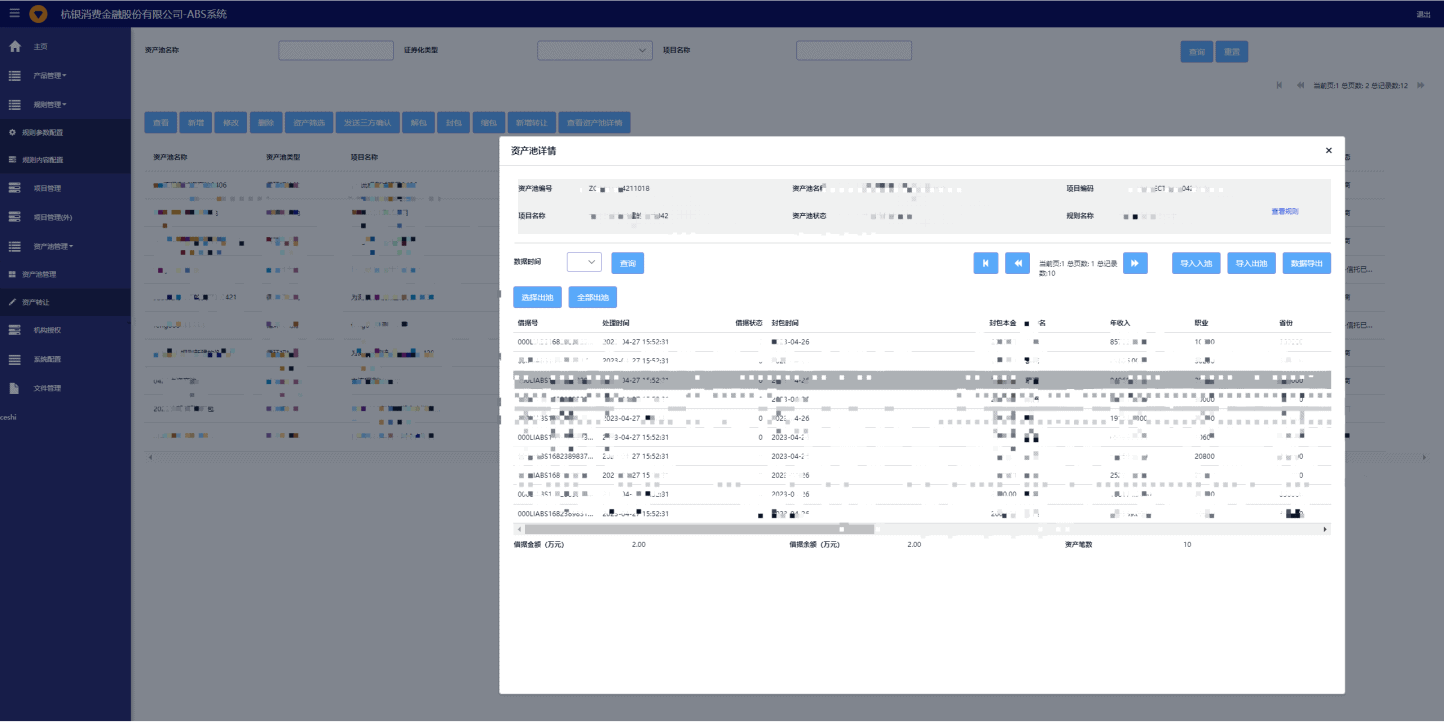

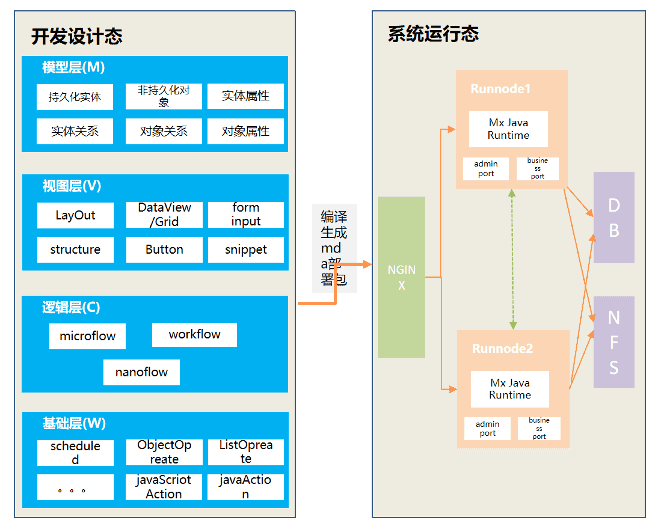

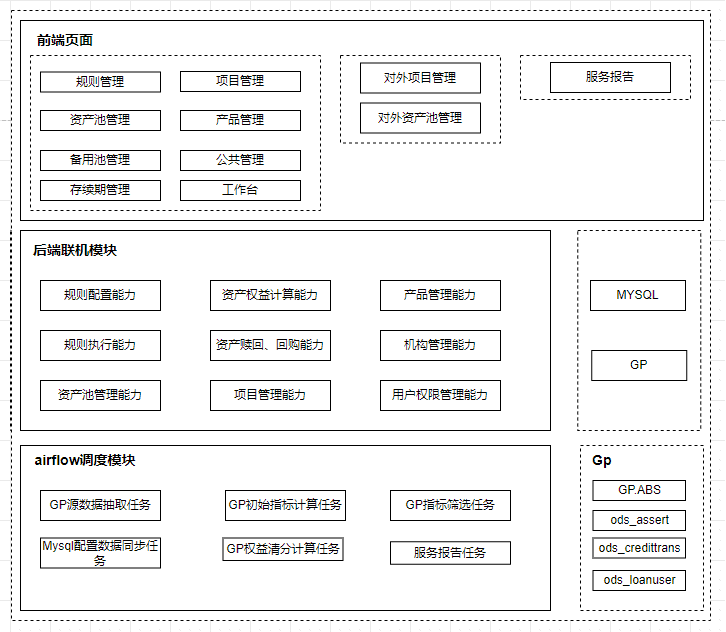

- ABS Asset Securitization System: This system supports the company’s ABS business operations. Components like Microflows, Nanoflows, Datagrids, DataViews, Scheduled Events, and Charts were utilized. The development was completed within one person-month, showcasing the platform’s efficiency.

Application Architecture Diagram

System Functional Architecture

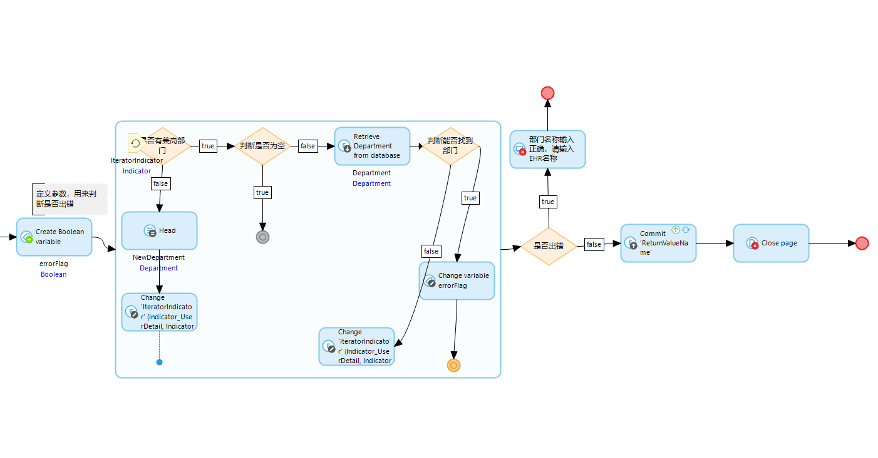

- Performance Evaluation Management System: This system facilitates employee performance evaluations by enabling staff to input evaluation content and scores. Key components include Microflows, Nanoflows, and Datagrids.

Microflow Components

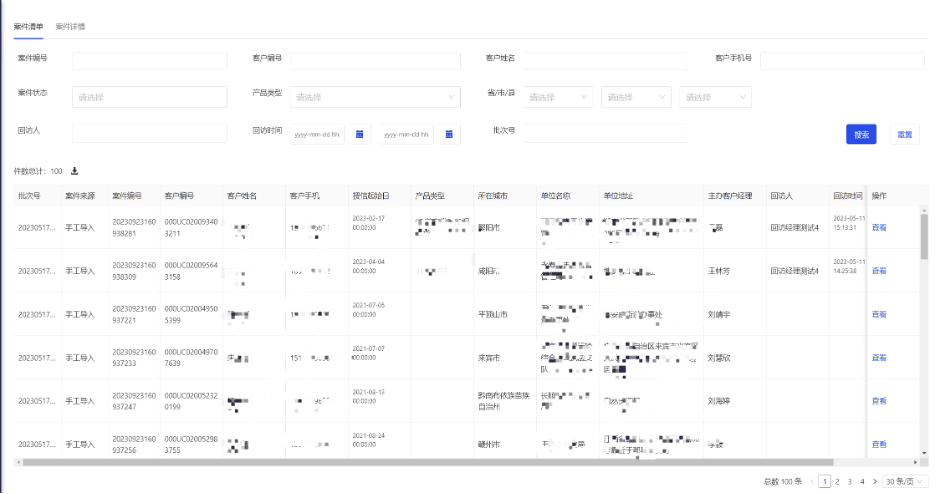

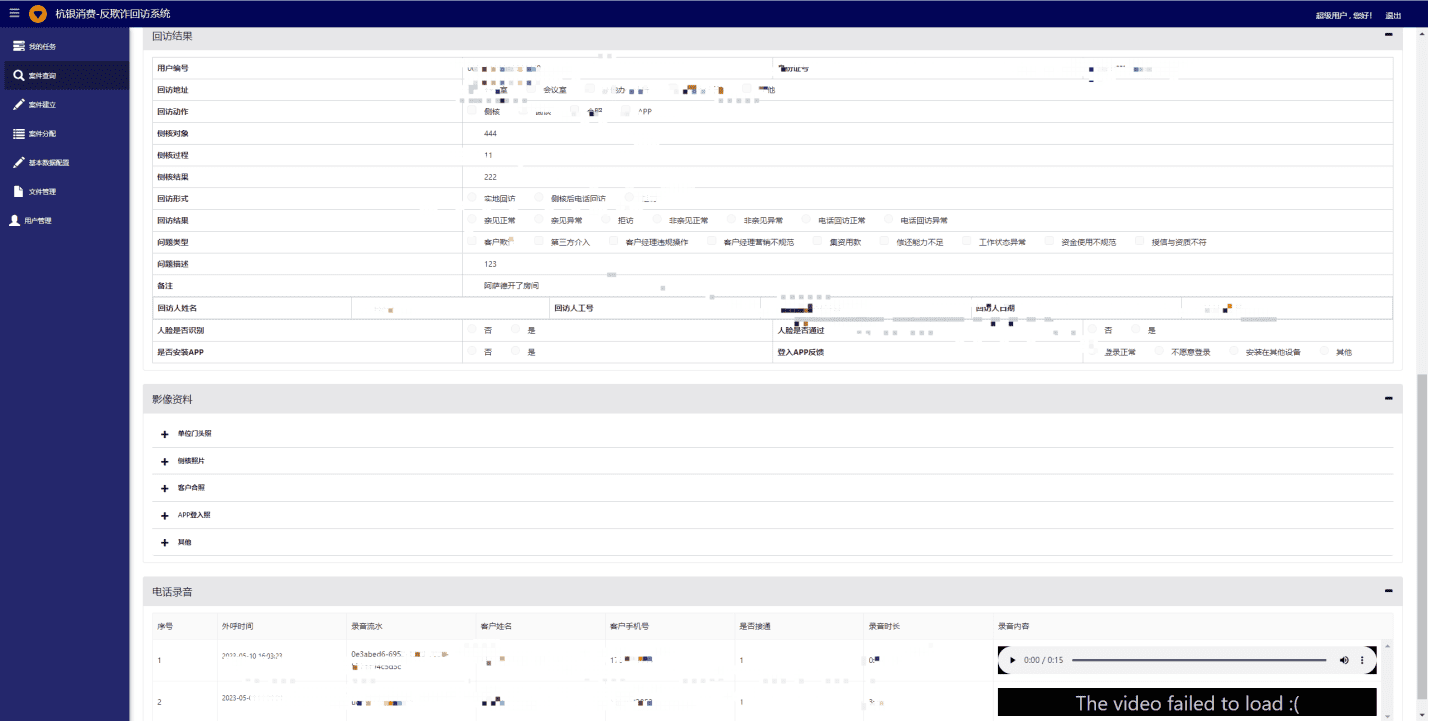

- Anti-Fraud Follow-Up System: Designed for fraud prevention follow-ups, this system also utilizes the standard components provided by Mendix to streamline processes.

Benefits of Low-Code

Hangyin Consumer Finance’s low-code applications have saved 30% of labor days compared to traditional methods, significantly improving development efficiency. The platform’s standardized processes minimized bugs, reducing testing and deployment time by 30%. Applications improved management efficiency by 20% after deployment.

After developing several applications, Hangyin Consumer Finance identified the following advantages of Mendix:

- Comprehensive front-end and back-end integration.

- Simple entity modeling based on business requirements for intuitive representation.

- Support for private cloud deployment.

- Standardized code minimizes errors during development, reducing runtime issues.

- Well-structured design processes suitable for complex business analyses and outcomes.

The team also expressed hopes for Mendix to enhance localization for Chinese developers and make advanced API usage more accessible.

Building on the success of the launched systems, Hangyin Consumer Finance plans to deepen its collaboration with Mendix for projects like budgeting, procurement, and regulatory reporting. With Mendix’s low-code capabilities, the company aims to further its digital transformation and operational efficiency.