The insurance industry is always looking for ways to streamline business processes and increase efficiency while creating better experiences for customers and employees.

Technologies including Robotic Process Automation (RPA) have disrupted insurance and many other industries—creating new challenges and opportunities. For insurance organizations, the most important person in the journey is the customer. Creating applications that automate processes and promote internal efficiency are great, but sometimes they add little value to the end user—until now.

RPA in Insurance

Insurance organizations are now coupling RPA with cognitive technologies including Machine Learning and speech recognition. Combining technologies can give bot automation applications new power to learn and increase their ability to communicate intelligently. This is especially useful for tasks that aren’t routine, but that require judgment and perception, such as underwriting.

Using new technologies in customer-friendly applications will increasingly help firms gain loyalty, making the mastery of these cognitive capabilities a key differentiator when competing with customer-centric insurtechs.

In fact, 83% of technology professionals believe there will be a cognitive tipping point in the next five years. While the RPA market today is still relatively small, the technology is gaining traction as a cost-effective alternative to traditional systems integration and is projected to become a $5 billion market globally by 2020, with a CAGR of over 60 percent.

Globally, the RPA Market is Projected to become a $5 billion market

Platforms including Microsoft Azure and IBM Watson have made these cognitive services more readily available and easier to consume, meaning that these technologies are no longer in our future, but they are very much in the here and now.

The Impact of Robotic Process Automation in Insurance

Technologies that automate insurance enable businesses to focus on the customer, and can result in better experiences for employees and agents as well. Specific examples of processes that are being automated through RPA are first notice of loss, fraud checking, and policy quotes and renewal — including data gathering and recalculating policy premiums. Some of the key benefits include:

- Reduced Error Rate from Human Processing: Robots don’t make mistakes or judgment calls, and they don’t get tired. With routine processes completed accurately, every time, you don’t need to allocate extra resources for making corrections.

- Cost Savings: With automation of work processes, operational costs are reduced and no additional resources are needed, increasing ROI.

- Increased Productivity and Efficiency: Robots don’t take coffee, lunch or holiday breaks. This means 24/7 monitoring and processing, increasing speed, efficiency and productivity. With robots taking over labor-intensive administration tasks, employees have more time for more high-value activities and work that can’t be automated, like customer service.

- Scalability and Flexibility: The ability to replicate robotic tools across geographies and business units increases scalability and flexibility.

Zurich Insurance used low-code to build a Terrorism Data Capture application to automate a legacy maniual process that was prone to error and time consuming. Not only were they able to build the application in 12 weeks through Mendix’s model-driven development and rapid prototyping platform, but they were able to save £280,000 per year through integration efficiencies and process improvements.

Another example of a successful RPA implementation is a large consumer and commercial bank that redesigned its claims process and deployed 85 software robots, or bots, running 13 processes, handling 1.5 million requests per year. As a result, the bank was able to add capacity equivalent to around 230 full-time employees at approximately 30 percent of the cost of recruiting more staff. Additionally, the bank recorded a 27 percent increase in tasks performed “right first time.”

How Can Your Organization Prepare for These Cognitive Gains and Take Advantage of New Technologies?

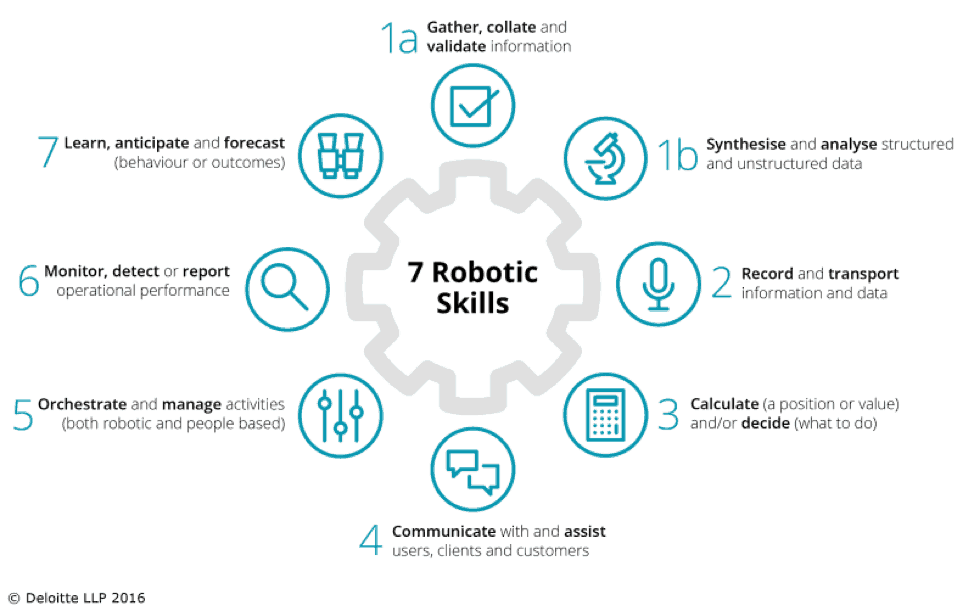

Deloitte has already deployed RPA software at scale with clients’ organizations and within an internal support process. By considering emerging cognitive tools through the lens of the customer, Deloitte has come up with 7 Robotic Skills that can drive new types of automation.

By breaking down these skills to figure out a) which specific tools deliver each skill and b) which skills are needed for your specific business case, you can figure out how RPA can benefit your business.

Iit is important to understand that the journey to automation starts with a proof-of-concept project, beginning small and iteratively proving the value. This can take as little as two weeks, with a live pilot up and running within two to six weeks, depending on the complexity and use cases. With success, you can quickly scale to a center of excellence where all areas of the business can automate their individual processes, leveraging a common set of skills, integration and people.

A proof of concept RPA project can take as little as two weeks, with a pilot up and running within 4 to 8 weeks.

This type of robotic and cognitive technology ultimately needs to be embedded in software applications that manage processes for the customer experience. To deliver the right software, you need to be able to rapidly experiment at low cost. To maintain momentum and speed, low-code platforms provide another layer of abstraction, enabling organizations to easily embed cognitive technologies in custom web and mobile applications.

Low-code platforms foster low-cost, high-value, rapid experimentation, allowing insurance firms to experiment with RPA to find business efficiencies and other optimizations. It is important to remember that an RPA bot can do much more than automate routine processes. Implementing RPA is just the one of the many ways organizations are looking to digitize their businesses and tap into the power of cognitive technologies.

This post has been updated. It was originally published on December 13, 2016.