How to Create New Innovative Insurance Products Fast

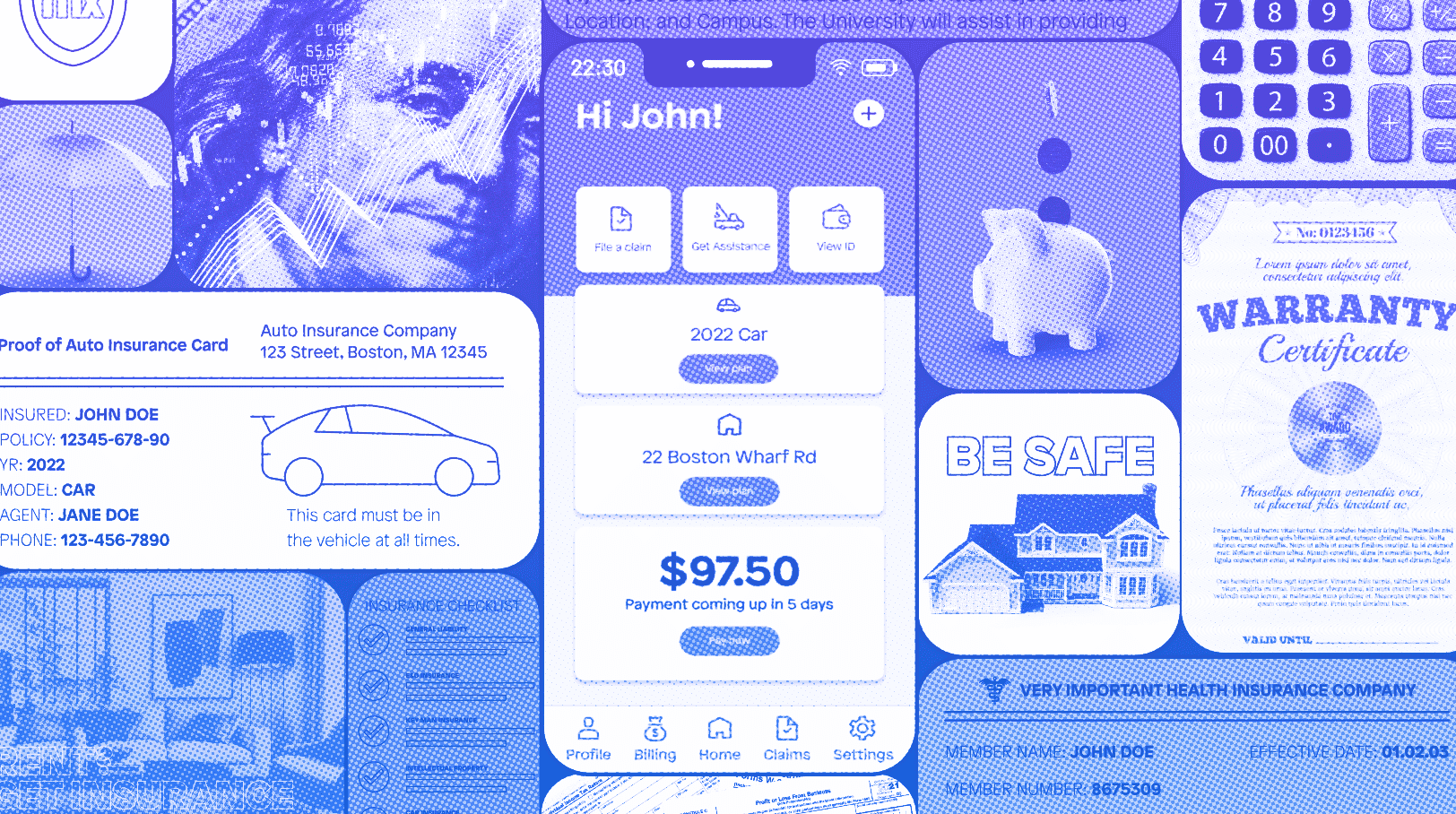

Everyone is talking about InsurTech innovation these days. In this blog post, we go over three things to consider if you want to create an insurance product quickly. We’ve also included examples of innovative insurance products to inspire you.

InsurTech products do not need expensive or time-consuming development processes to offer superior service and customer experience. Read on to learn more about the ways that new technologies are transforming the insurance industry.

Insurance companies are racing to digitize their businesses and one of the biggest opportunities is the introduction of innovative new insurance products through digital channels. But many insurers worldwide say they lack an achievable plan to carry out a successful digital transformation. Forrester Research, in a January 2019 report, The Future of Insurance, Vision: The Digital Insurance Strategy Playbook, noted that, “Digital Insurance teams need to scan relentlessly, increase efficiency, reduce costs, and drive business growth. For digital insurance initiatives to deliver the expected outcomes, digital executives need a vision that moves their firms from experimentation to delivering business outcomes.” Those digital insurers that bring tailored and scalable products and services to market, fast—and at a low cost—will gain a significant advantage over those that can’t.

Digital insurers that bring tailored and scalable products and services to market, fast—and at a low cost—will gain significant advantage over those that can’t.

Many innovation opportunities are right under insurers’ noses, but they need to know where to look.

3 things to leverage for insurance product innovation:

1. New technologies

New technologies like IoT (the Internet of Things) can open up opportunities for growth and innovation in the insurance space. IoT is ultimately changing what consumers know and how they interact with insurers.

With the plethora of sensors leading to massive amounts of data, risk determination can now be based on individual customers’ characteristics and behaviors. This change can impact the core business model and create the opportunity to shift from reimbursement to prevention. By leveraging digital technologies and customer data, providers can take existing products and tailor them to the user for a superior customer experience.

A great example of this data and technology-driven product innovation comes from UnitedHealthcare. The insurer offers policyholders savings of up to $1,000 annually for wearing internet-connected wristbands. The fitness-tracking service is part of UnitedHealth’s employer-sponsored program aimed at integrating wellness benefits with their health insurance products. Customers earn points for various activities, which are calculated for policy discounts.

It makes sense for companies that are encouraging workers to get fit to provide an incentive to do so. Healthy workers should cost their insurers less money. The health insurance giant offers three walking goals with an acronym, “F.I.T.” which stands for frequency, intensity, and tenacity. People who move frequently and log around 10,000 steps a day can have a great deal of savings on their annual policy. The best part about the program is that the insurance company is noticing participation from not just the already fit, everyone is jumping at the chance for these savings.

UnitedHealthcare’s use of fitness tracker savings follows similar initiatives in the auto insurance industry, such as Progressive Insurance’s SnapShot and State Farm’s InDrive. Both use internet-connected devices to transmit information about customer driving habits in exchange for lower rates. Going forward, these types of technology-infused products will become the norm across all segments of the insurance industry, as providers look to attract and retain digitally savvy audiences.

2. New channels

Adjacent innovation opportunities can also be found in new channels and business models. Taking your existing product and changing the way your customers interact with it allows you the opportunity to create a better experience for them and eliminate any friction in the process.

Innovative insurance products always prioritize the customer experience. Done well, an innovative insurance product empowers users and benefits companies and customers alike.

One company that is taking their existing products into a new channel is a specialty insurance company that wished to implement a new model that allowed them to eliminate intermediaries and sell directly to the customer.

By cutting out the middleman (broker) and selling directly to the customer, this insurer can offer products at a lower, more competitive price because the cost of sales decreases. In turn, they can immediately increase revenue.

This is a high transactional model, so they created a multi-channel solution that is self-service and fast. They built an application for liability insurance, which allows end customers to get quotes and buy and manage their policy without needing to do any interaction offline. This flexible, automated solution supports the new business model of selling directly to customers, with the advantage of being able to come in with lower prices.

3. New demographic focus

Focusing on new demographics can help reshape an existing product to create a new offering. The Millennial and Generation Y age group is becoming a significant target segment for insurers, as well as Zoomers and Gen-Z. Fourteen percent of young adults remained uninsured in the U.S. by the end of 2018. This moderately large market represents the next generation of core customers for insurers, meaning the competition in this market is high.

This is an opportunity for insurers to offer products and services that meet the specific needs of distinct customer groups. For example, baby boomers might be interested in products that protect their current standard of living, while younger consumers may want to spend some of their disposable income on products that help them purchase new homes or cars when credit is tight. And targeting a younger consumer means that online and mobile access becomes key. The idea is to identify and prioritize groups of customers that offer untapped business opportunities in order to repurpose existing products for a new demographic.

Your bottom line

Many insurance companies already have valuable assets required to build these innovative solutions, including extensive distribution networks, partner relationships, and products that can be re-purposed for other customer segments or distributed via new channels. Many of these assets are not fully utilized to offer relevant value propositions to customers beyond the standard set of insurance products. The reality is that these existing assets make it easier for insurers to innovate faster.