According to the Forrester report, The Future of Insurance, “There are big changes in store for the business of insurance as a result of digital technologies. The impact of the digitally empowered customer is palpable across the insurance industry. Products, payments, distribution, underwriting, and operations will look very different in the next five to 10 years.”

The insurance business is changing at a previously unheard-of pace, and “the velocity of change in insurance is only going to increase.” Think about what these digital transformation trends mean for your business. Can you afford not to be actively working toward your digital future?

For decades, insurers have relied on brand, product, and vertical integration to retain customers and grow market share. However, as the customer base continues to skew more toward millennials and the world becomes increasingly digital for all populations, insurers face the risks of providing an unappealing service that loses customers to both traditional competitors and disruptors.

“The future of insurance will be personalized and customizable, rather than one-size-fits-all.” That means your customer experiences need to be streamlined, localized, and customized. So how will your customers interact with agents and brokers? How will customers make claims? How will you help your customers to understand their risks at a better price?

As if that’s not enough to deal with, customers are increasingly looking for added value. A strong brand name offering a good product at a competitive price is no longer enough. To succeed in the long term, insurance companies will differentiate themselves with the value and overall solutions they can provide, rather than brand and product.

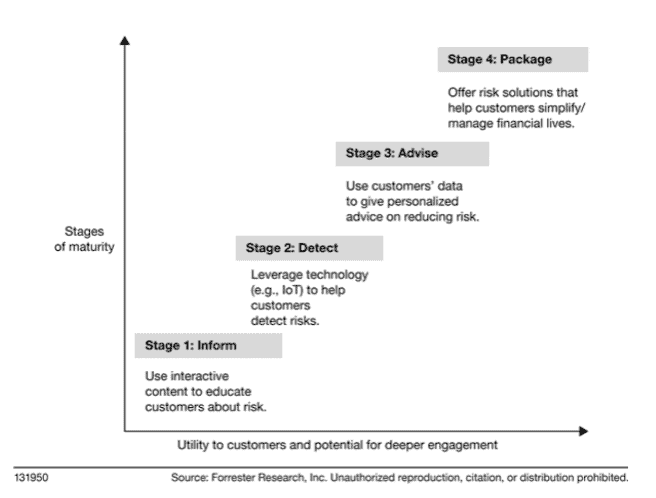

Image from “The Future of Insurance,” Forrester Research, Inc., 18 March 2021

These aren’t secrets. Most savvy insurance experts would say the same thing. So why is this needed digital transformation something so many insurers are struggling with?

Choose the path, walk the path

The slow, iterative change that’s been part of the insurance industry for generations is no longer a viable option. Many insurers are handicapped by an app development strategy that, to be fair, has been incredibly successful for a really long time. But “the vertical integration that has served insurers so well in the age of distribution and the age of information has become an obstacle to needed innovation and rapid change in the age of the customer.”

This model of acquisition and development means that many organizational roadmaps are stuck on a monolithic treadmill. Years of entangled legacy systems and processes mean change appears to be difficult and expensive at best and impossible at worst.

Now, insurers face the proverbial fork in the road. The road to digital innovation requires commitment. Walking that path requires leadership teams to “pivot their strategy to a fundamentally outside-in, customer outcome-focused mindset.” The other direction may feel safer but winds toward irrelevancy and lost market share.

To be clear, there’s no magic solution. Dismantling a monolith requires time and effort. Unfortunately, many organizations make the mistake of thinking too big and not seeing early wins, then abandoning in favor of the old “let’s put out the fire” strategy.

Many organizations are talking the talk, but, as the report notes, “digitizing the business of insurance demands more than a vision.” Vision is just the first step. Change starts with that first step, though, so let’s talk through how Mendix can help pull your digital insurance ecosystem together.

Translating vision to action

Self-assessment is crucial to any kind of development and transformation. Low-code has been following that model for years, and it’s something that Forrester analysts agree with: “Understanding your competitive position forms the basis for action and investment.”

Mendix development enables your business and IT stakeholders together to come together on critical questions:

- Where are we strong?

- Where are we weak?

- Are we providing the best possible online and mobile experiences for our employees, third parties, and customers?

- Where can we start?

The last question is a common blocker. With minimal or even no resources, digital transformation can be daunting. To help combat that, Mendix has created three solution templates designed to help you get started:

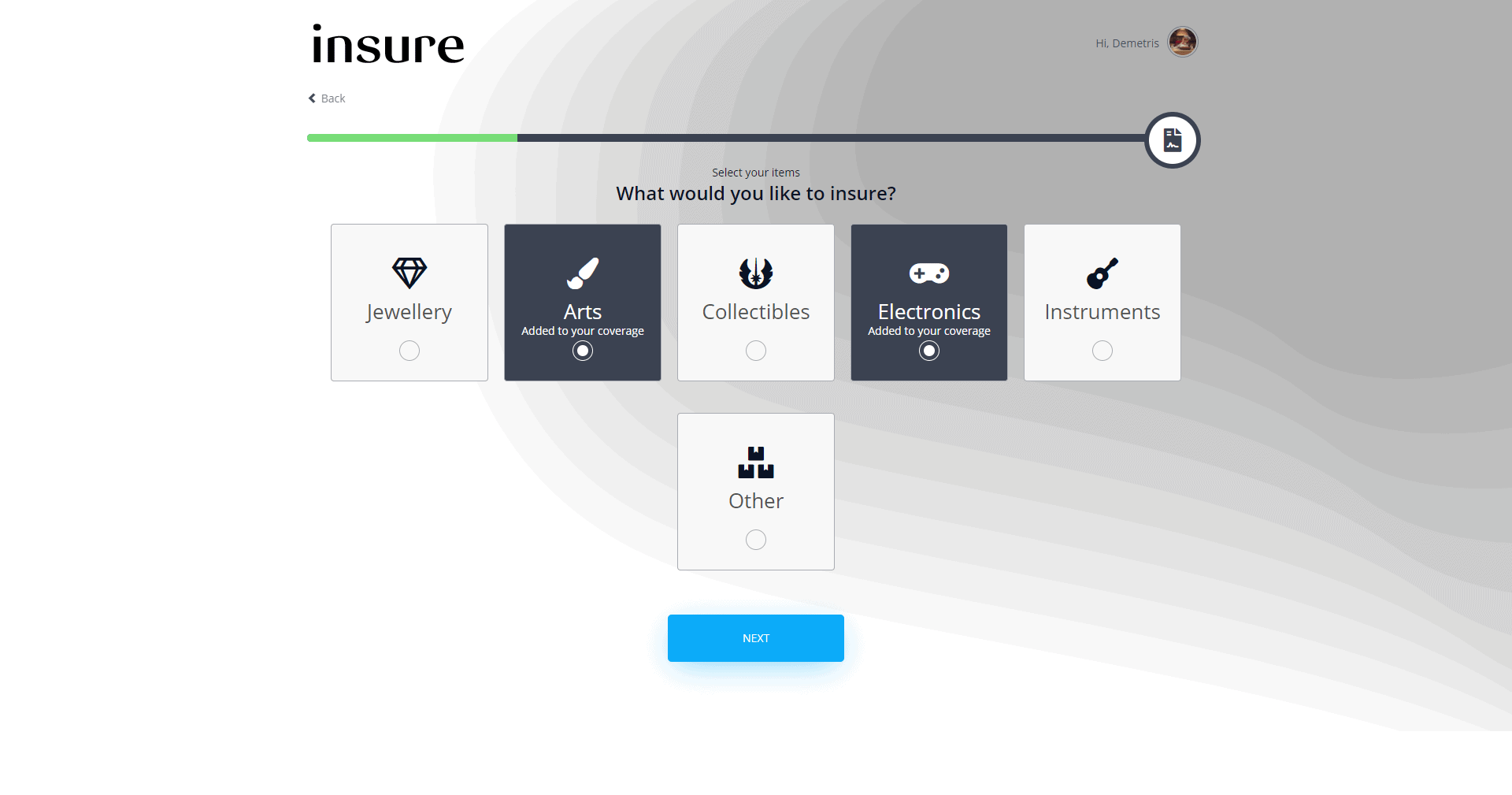

- Underwriters Workbench: Deploy an automated underwriting experience that will allow you to see and report on your entire workflow. Improve customer mobile and online digital experience.

- Quote and Buy: Generate quotes in live time using AI and connections to your core systems. Increase business agility. Adapt and grow the template to meet your organization’s specific needs.

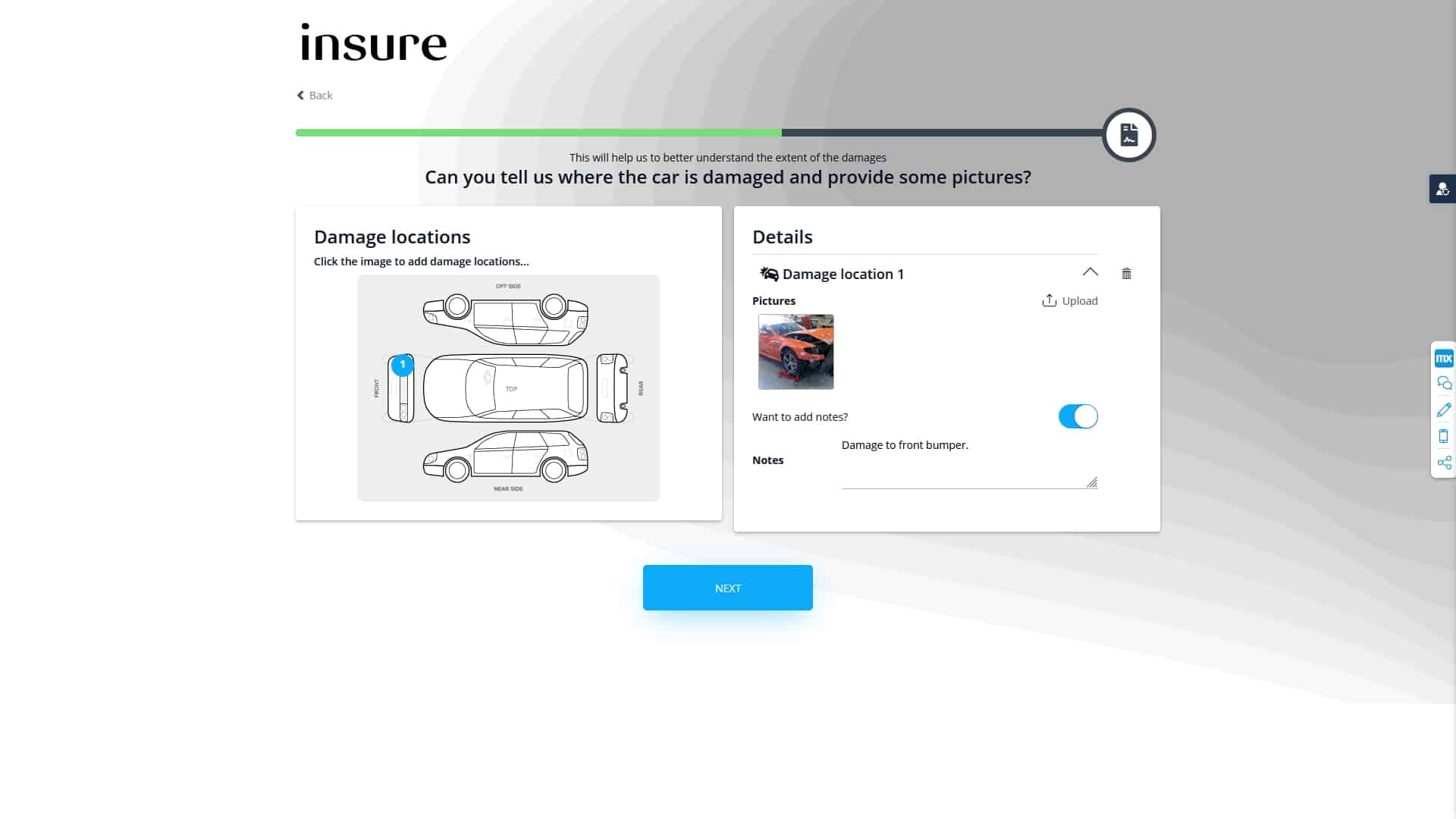

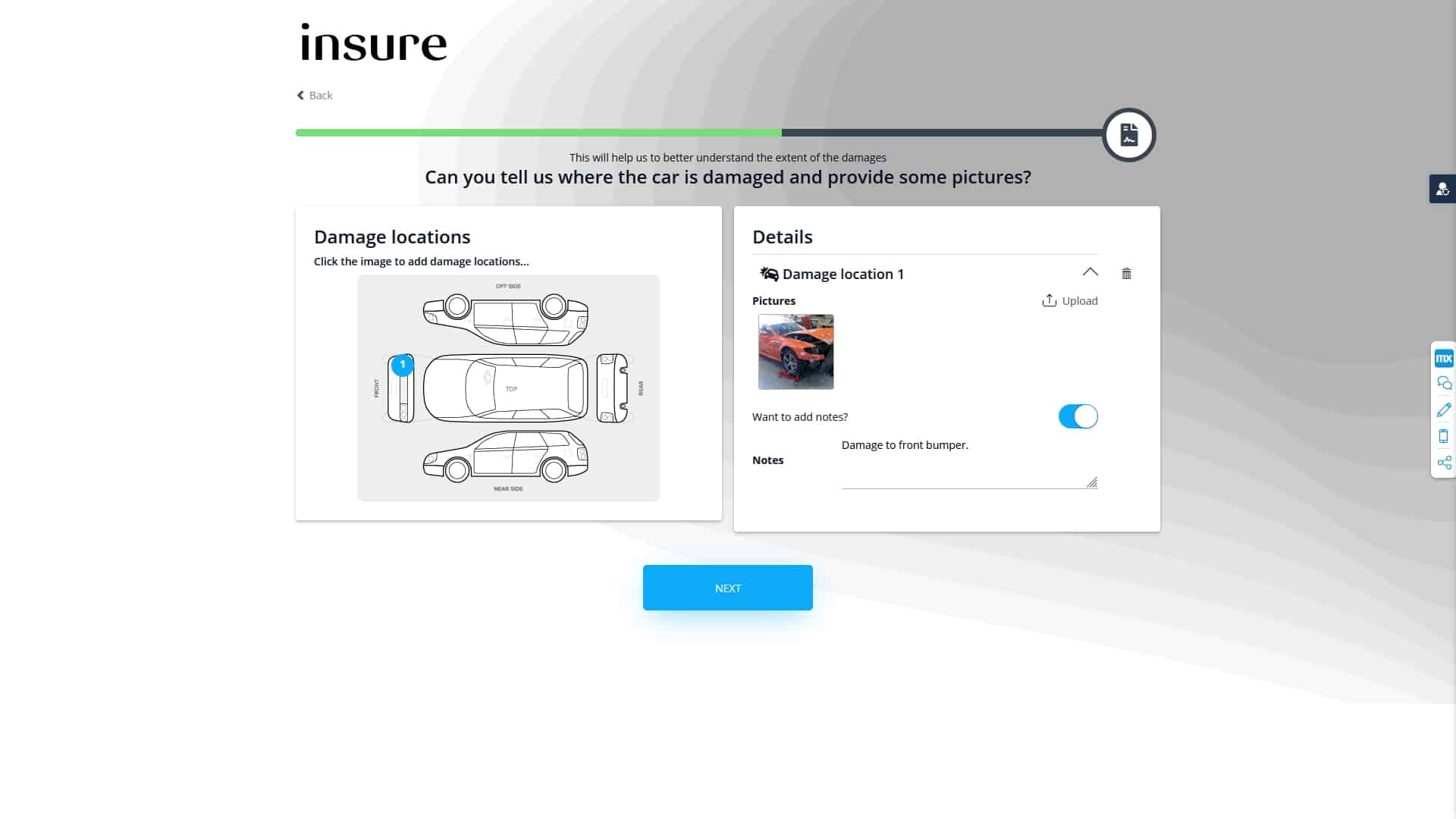

- Claims Management: Allow customers to submit claims in minutes with images and geolocation. Automated routing and monitoring bring transparency to your workflow and reduce process strain for your adjustors.

These building blocks are lightweight, flexible, totally customizable, and link to your core systems. Think of them as your springboard to innovation and digital transformation, with Mendix as the tool to translate your vision into execution.

To see how insurance organizations are using Mendix, look at the case of Zurich Insurance. Zurich faced the challenge of digital disruption while looking to increase market share. As an organization with thousands of employees and millions of customers, this is akin to building a brand-new house on your current foundation while you’re still living there.

However, in just over six months with Mendix, Zurich released applications that created nearly £300,000 in annual operation savings, increased revenue by £5 million, and allowed for faster, more automated quote processing. Those stats are eye-opening, but with Mendix, they’re achievable for your organization.

Mendix helps insurers to develop faster and with fewer resources, release more quickly, and get solutions that revitalize your customer experience into action immediately.

Better data=better experiences

Mendix applications, including the solution templates, are designed to capture and aggregate data. This gives you better insights into customer behaviors, which help you automate processes and incentivize customers.

The report notes, “Insurers have traditionally worked with third-party data providers that generate and stockpile data such as credit scores and vehicle accident data to understand and serve customers. The internet of things (IoT) will enable insurers to underwrite more effectively and contextually sell dynamic insurance solutions.”

To put that into context, American Family Insurance recently offered its customers a free line of smart home products. AFI collects data from those products, which then go toward building automated, AI-driven quotes and claims. The free products entice customers to enter the AFI ecosystem and stay there. Increasing customer engagement with your organization increases retention in the long term.

You can extend this idea into other areas, such as wearables. “The internet of things and sensor technologies are creating significant data opportunities for insurers,” reads the report. “Wearables collect real-time data that underwriters can use to price insurance more effectively. There is a large opportunity for insurers and vendors to capture, analyze, and deploy this data.”

More data around claims means less risk, fewer severe claims, and fewer bad payouts for the business. Data also enables the business to better understand and give customers a more accurate risk assessment and quote. With Mendix, data collection and reporting are baked in and customizable to your needs.

Disruption to differentiation

As you consider your organization’s digital future, keep in mind Forrester’s key pillars of “Create better customer and/or agent experiences, increase efficiency, reduce costs, and drive business growth.” Mendix can help you with solutions to build on all four of those pillars today.

For an industry facing significant disruption, digital transformation is a scary but necessary proposition. However, by using Mendix to execute your vision and improve customer experience, insurers can win customers and be ready for the future. So take the first step and transform the risk of disruption into a differentiator for your organization.

All quotes from “The Future of Insurance,” Forrester Research, Inc., 18 March 2021