Zurich FaceQuote Goes from Idea to App in Weeks

Recent research by Zurich UK indicates that a quarter of people don’t have life or critical illness insurance because they believe it is too expensive, and 30 percent said they didn’t feel it was relevant. When asked about how much they believe life insurance would cost for a healthy 40-year-old, 14 percent believed the cost would be more than £40 per month, when actual coverage for such a person could cost as little as £8.

With this market opportunity in mind, Zurich investigated new ways to promote life insurance adoption across the UK market. Traditionally, prospective life insurance customers engage through an insurance broker or are motivated and knowledgeable enough to self-select into coverage, completing a buyer’s journey from the quote and buy to acquire a policy.

This new customer engagement paradigm would need to engage with prospective customers that would not otherwise consider coverage.

Say, Cheese!

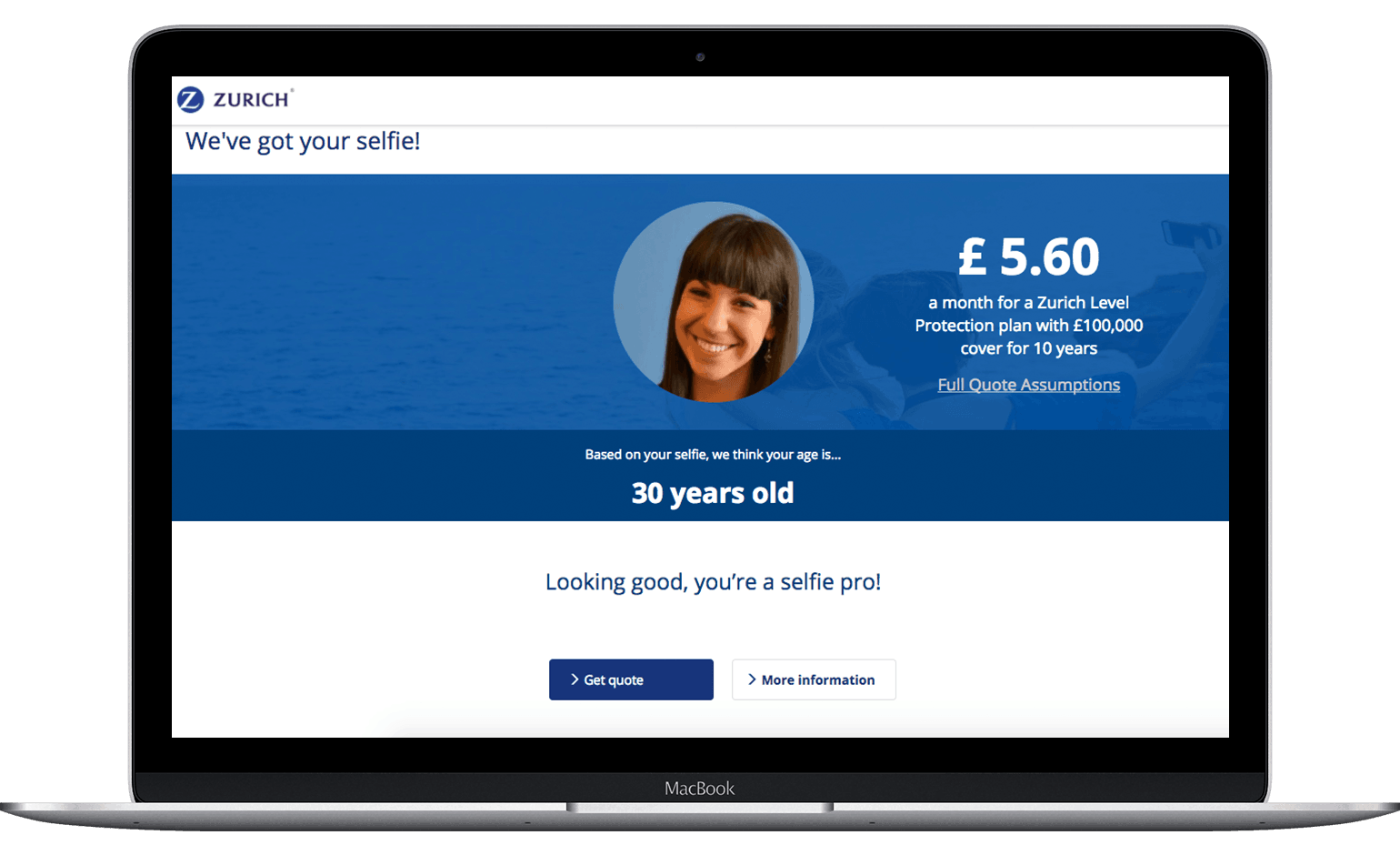

FaceQuote is a frictionless, first-to-market application available on web and mobile devices. The application is comprised of only two pages, providing a simple, nearly instantaneous idea of what life insurance would cost a typical customer.

The user’s selfie is sent by FaceQuote to an image processing intelligence that provides an educated guess of the user’s age with just one click. The estimated age then drives an estimate of a life insurance premium for the user.

Based on Zurich’s aforementioned research, this premium estimate will typically be far lower than the market anticipates. If the user is interested, FaceQuote connects them with an online portal where they can apply for life insurance based on their estimated premium.

“Technology has a huge role to play in allowing us to connect with a wider audience and give more people confidence in making financial decisions but also inspiring and enabling them to take control and put proper plans in place,” said Chris Atkinson, head of consumer distribution at Zurich.

“We know that many people prefer not to think about what will happen to them or their dependents if they become ill or were to die. So we’ve tried to approach these issues through gamification, in a fun and engaging way in the hope that some people will be nudged into action,” he added.

Newfound Development Speed

Zurich, desirous of an approach that would allow them to be fast-to-market to test and learn about this new approach, chose the Mendix low-code platform to develop the FaceQuote app.

The development team was comprised of just two people – a Mendix developer and a UX/UI expert. Over the course of two weeks, the Zurich team worked in an agile manner with these two developers, assigning a Product Owner and Scrum Master to participate in four demos, quickly iterating toward a working application. Ultimately, the front end took only four days to create, and total development time just seven days.

Zurich is also using Mendix to develop other applications.

A New Customer Engagement Paradigm

The FaceQuote app enables Zurich to reach a wider market by offering users a way to interact and get a quote with the technology they engage with every day: the camera on their phone.

Zurich aims to complement its existing channels, including brokers, to tap further into a younger demographic with a design thinking approach, using empathy to understand how their user would want to interact with insurance. The company has essentially paved the way for a new kind of interaction between users and insurance providers by creating a simple and intuitive way to engage.