Underwriting

Don’t be constrained by changing your underwriting process to fit an off-the-shelf product. Quickly build an application that makes sense for your organization with Mendix.

Why build with Mendix rather than buy off-the-shelf?

No two Underwriter Workbenches should look the same. Part of the appeal is that underwriters can tailor the design and integration of data into their workbenches to the exact needs of their line of business.

The Mendix platform enables insurers to create an Underwriter Workbench from a customizable template. Building for the multi-touchpoint, multi-modality underwriter journey doesn’t have to be a cumbersome development process. Now you can create a composed experience assembled from a set of packaged business and technical capabilities.

Want to see what you can build quickly?

Mendix and Capgemini have partnered to deploy insurance-specific templates designed to change how insurers and customers think about the digital future.

One of these templates is an Underwriter Workbench. It acts as a starter for your development processes that can be easily customized to have your branding, your workflows, and connect to your core systems. It’s the simplest and fastest way to build a totally customized application for your enterprise.

Want to learn more? Check out our webinar Improving efficiency and decision making with Underwriter Workbench.

What are the features of a contemporary Underwriter Workbench?

-

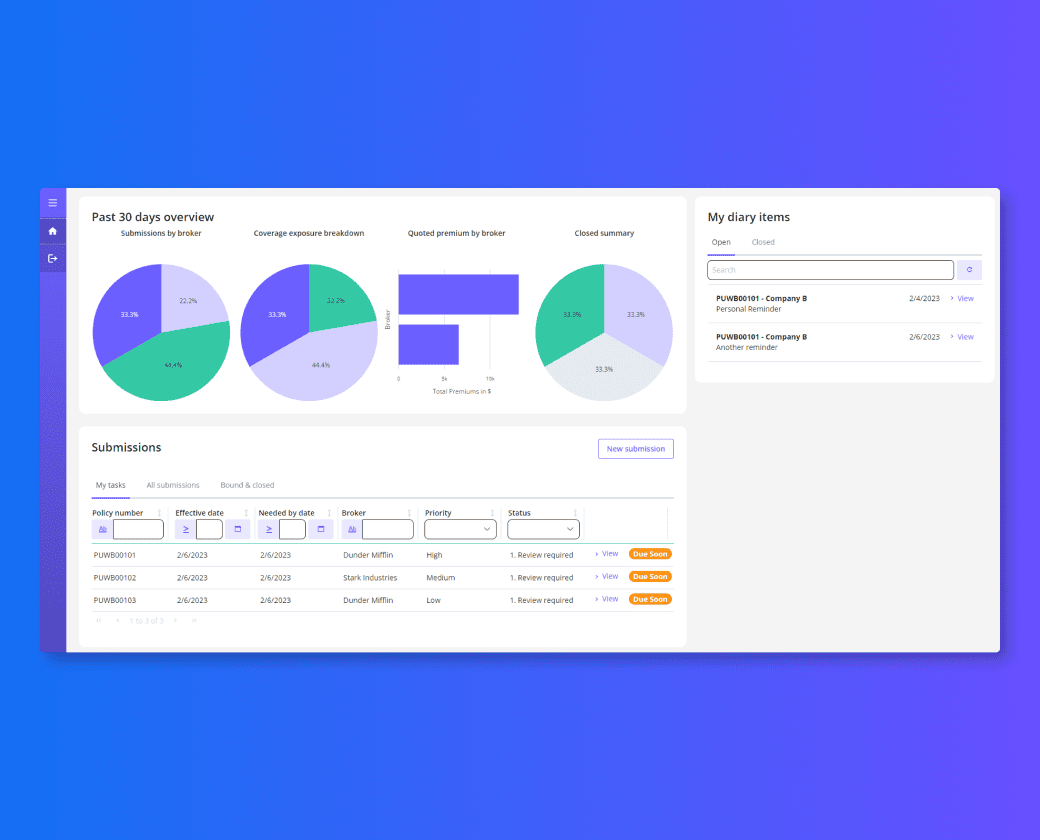

A single user-focused dashboard

-

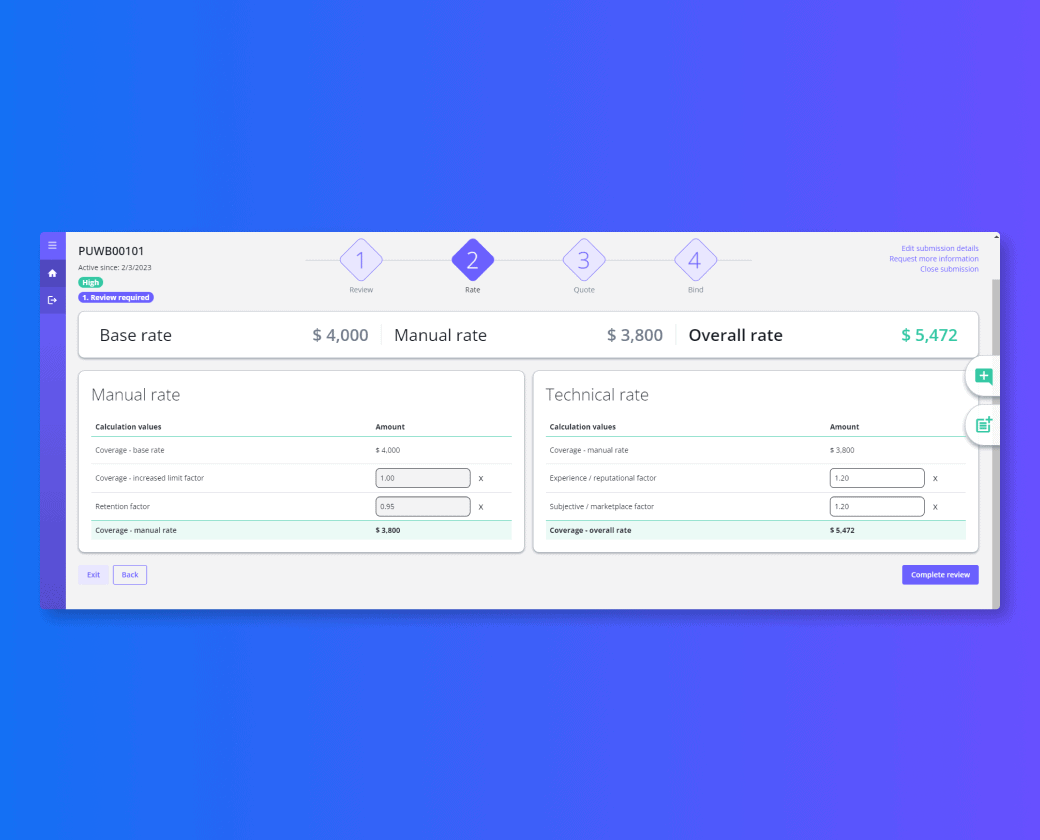

Ability to integrate key tools for KYC, rating, and policy administration

-

Ability to integrate advanced AI and automation tools

-

Underwriting authority and visible audit trails

-

Real-time MI and operational reporting